Well, what’s the next step after they have ran their analytics and  made their decisions…they sell the data, error ridden and all. Again it’s the wild wild west and information can be real or it can be fake. I somehow think that some of this will end up moving more folks away from social networks. Granted what they are using is what is public but so do other sites who scrape data. If you have not seen the great 60 Minute report on credit agencies and their flawed data, you can find it over at the Algo Duping page.

made their decisions…they sell the data, error ridden and all. Again it’s the wild wild west and information can be real or it can be fake. I somehow think that some of this will end up moving more folks away from social networks. Granted what they are using is what is public but so do other sites who scrape data. If you have not seen the great 60 Minute report on credit agencies and their flawed data, you can find it over at the Algo Duping page.

This again takes me back to my same old campaign with licensing and excise taxing the data sellers who make billions upon billions just selling data and help keep the inequality going in the US with using data out of context and selling erroneous data as being accurate in some areas. Now they can even use a “faceprint” to identify you.

Licensing and Excise Taxing Data Sellers, Facial Recognition Yet One More Tool Used To Secure & Match Data - The Epidemic, Billions in Profits for Banks and US Corporations Using Killer Algorithms to Further Erode Consumer Privacy

Not too long ago it was reported that health insurance companies are buying your credit card and debit purchases too. So now what? Will they be able to tell that you can’t afford health insurance when they aggregate? (grin) Credit data is riddle enough as it is as corporations and banks don’t timely update, so do you wonder why it takes you so very long to fix mistakes? We do this as consumers on our own dime while banks and corporations make billions selling it. They have a captive audience as we can’t do much of anything as they control the data and how it gets interpreted.

insurance Companies Are Buying Up Consumer Spending Data-Time is Here to License and Tax the Data Sellers-As Insurers Sell Tons of Data, Gets Flawed Data When Data Buyers Uses Out of Context Too

This article states they are using the data to find fraud and sure there might be a little of that going on, but the real deal here is money and more data for sale. It’s an epidemic. Richard Cordray is so far behind the times with technology that his agency is of little use to really help consumers, but what do you expect from an attorney anyway.

Data Floating Around the Web and You Don’t Know How It Got There? Time to License and Excise Tax Data Sellers–Identify “Flawed Data” Epidemic At The Root of the Problem

“But she didn’t know which company had collected and shared the data in the first place, so she didn’t know how to have her entry removed from the original marketing list. “

As I keep saying, time has come to excise tax and license the data sellers to raise some nice tax revenue for the NIH and FDA and identify who they all are and what kind of data they sell and to who. Without licensing, Congress and other federal agencies are just spinning their wheels with privacy and banks can continue to lie about their risk but let’s bring this tiny consumer down to their knees. BD

Time Has Come to License and Tax the Data Sellers of the Web, Companies, Banks, Social Networks..Any One Making a Profit-Latest Microsoft/Google Privacy War Helping the Cause –Consumers Deserve to Know What Is Being Sold and To Who in a Searchable Format

Credit bureaus and payment companies are testing ways to use social media -- say, a Facebook Inc. (FB) post about a recently purchased Corvette -- to verify a person’s identity and even assess consumer creditworthiness.

Equifax Inc. (EFX), EBay Inc. (EBAY)’s PayPal and Intuit Inc. (INTU) have begun trials to see whether social posts can help prove identities, and, in some cases, detect whether customers are lying about their finances.

“We are investing a lot in how can we use unstructured data that is sitting out there in social media that can help us understand a little more about identity,” Rajib Roy, president of Equifax Identity and Fraud Solutions, said in an interview.

While the companies can only access public information or what people choose to share, a great deal is readily accessible. Many young people allow the public to see certain parts of their Facebook profiles, as well as accounts on Twitter and LinkedIn Corp. (LNKD) Consumers also leave traces of themselves on blog posts, Yelp Inc. (YELP) reviews and online forums.

While scouring the Web can help companies combat scams, it can heighten concerns among consumers and privacy advocates who say social-media sites don’t do enough to protect users’ data. The U.S. Consumer Financial Protection Bureau and Federal Trade Commission have started examining how debt collectors use Facebook and Twitter to contact potential debtors.

Credit bureaus refer to social-media posts and photos as self-efforted data, or information voluntarily provided by the consumer, which can be inferior to data gathered from banks and phone companies. The problem with the user-provided information is the same as it was in 1999, when chat rooms were filled with purported 21-year-olds who were actually 12.

Providence is not for profit and operates 5 states with 27 hospitals. Their headquarters is located in Washington state.

Providence is not for profit and operates 5 states with 27 hospitals. Their headquarters is located in Washington state.  insurers and others progress reports on patient progress. I guess this way with the reports there should be no question on the progress made by each patient using the device after having suffered a stroke. The company also partners with NASA and you can

insurers and others progress reports on patient progress. I guess this way with the reports there should be no question on the progress made by each patient using the device after having suffered a stroke. The company also partners with NASA and you can  Today's FDA clearance allows AMES to market and sell the device. AMES anticipates delivering the device to hospitals and clinics in early 2014. The typical patient population that possibly receive treatment with an AMES Device would include stroke victims and patients with partial injuries to the spinal cord injury patients. The AMES rehabilitation medical device uses robotic technology to assist a patient in moving the affected limb while vibrating the muscle receptors at the same time. During use, the patient's input effort and other parameters important in therapy are measured and recorded by the AMES Device and displayed to the patient as real-time visual biofeedback. The AMES Device can also perform several diagnostic tests each time a patient is treated by the device to track progress for clinicians and insurance providers.

Today's FDA clearance allows AMES to market and sell the device. AMES anticipates delivering the device to hospitals and clinics in early 2014. The typical patient population that possibly receive treatment with an AMES Device would include stroke victims and patients with partial injuries to the spinal cord injury patients. The AMES rehabilitation medical device uses robotic technology to assist a patient in moving the affected limb while vibrating the muscle receptors at the same time. During use, the patient's input effort and other parameters important in therapy are measured and recorded by the AMES Device and displayed to the patient as real-time visual biofeedback. The AMES Device can also perform several diagnostic tests each time a patient is treated by the device to track progress for clinicians and insurance providers. Montefiore would assume the Sound Shore buildings and other assets and operate the two hospitals.

Montefiore would assume the Sound Shore buildings and other assets and operate the two hospitals.  be new (grin) and there’s no guarantee the FDA will approve the process. Then you have insurance companies not covering the donor testing, what a hassle.

be new (grin) and there’s no guarantee the FDA will approve the process. Then you have insurance companies not covering the donor testing, what a hassle.  It may take a while to iron out all the provisions, etc. The Health Plan is expected to be given a new name. The reason for selling this division appears to be money as they lost $14 million in the first quarter operating in Ohio and it was nearly $60 million in the red at the end of last year. Well maybe there will be no more abortions since the Catholic system is buying it too (grin) and nor will they be participating in the Ohio exchange as the insurance business is going with the sale. BD

It may take a while to iron out all the provisions, etc. The Health Plan is expected to be given a new name. The reason for selling this division appears to be money as they lost $14 million in the first quarter operating in Ohio and it was nearly $60 million in the red at the end of last year. Well maybe there will be no more abortions since the Catholic system is buying it too (grin) and nor will they be participating in the Ohio exchange as the insurance business is going with the sale. BD  look at the marketing of some of this you do have to laugh. This is why half of the analytics that come out are going to be useless. Learning is great and when models are created this can be a good education experience but wait until the banks and insurers demand perfection and ways to lower risk. Will the machine learning help the employees then? It all depends on what is programmed in…it’s like this picture I have here called “The Algo Fairy”.

look at the marketing of some of this you do have to laugh. This is why half of the analytics that come out are going to be useless. Learning is great and when models are created this can be a good education experience but wait until the banks and insurers demand perfection and ways to lower risk. Will the machine learning help the employees then? It all depends on what is programmed in…it’s like this picture I have here called “The Algo Fairy”.  algorithmic issues of banks and insurance companies. One thing that I do question though is the integrity of being a fully qualified Quant with a lot of responsibility and then seeing the mini modeler as a comparison? Who will be accountable here when models are made just for making money and no concern for how it plays out to the end consumer, anyone? Will the fact that the automated models can be sold have an impact? We will just have to wait and see.

algorithmic issues of banks and insurance companies. One thing that I do question though is the integrity of being a fully qualified Quant with a lot of responsibility and then seeing the mini modeler as a comparison? Who will be accountable here when models are made just for making money and no concern for how it plays out to the end consumer, anyone? Will the fact that the automated models can be sold have an impact? We will just have to wait and see.  Tafinlar belongs to a class of drugs called BRAF inhibitors. There’s also a test approved by the FDA that identifies to determine of the melanoma cells have the mutations in the BRAF gene. Glaxo has a focus on skin cancer drugs and it was in 2012 they received approval of another drug that extends life for those with late stage skin cancer.

Tafinlar belongs to a class of drugs called BRAF inhibitors. There’s also a test approved by the FDA that identifies to determine of the melanoma cells have the mutations in the BRAF gene. Glaxo has a focus on skin cancer drugs and it was in 2012 they received approval of another drug that extends life for those with late stage skin cancer.  Chief way over his head from the other side that knows little or nothing about math and business models. In addition we have those Medicare re-admission penalties that hospitals have to be aware of too, so what’s the deal here?

Chief way over his head from the other side that knows little or nothing about math and business models. In addition we have those Medicare re-admission penalties that hospitals have to be aware of too, so what’s the deal here?  go through the system that will never be detected or found as well. It also makes you wonder about the activities of HSBC and their money laundering issues t where they were laundering money for Mexican drug cartels and why they were not prosecuted? It does make one question and ask about payment systems and to make sure it is not a money transmitter too. You do wonder how many more of these types of operations are out there or how many will attempt to spring up in the future too.

go through the system that will never be detected or found as well. It also makes you wonder about the activities of HSBC and their money laundering issues t where they were laundering money for Mexican drug cartels and why they were not prosecuted? It does make one question and ask about payment systems and to make sure it is not a money transmitter too. You do wonder how many more of these types of operations are out there or how many will attempt to spring up in the future too.  financial service, and insurance providers. This should come as no surprise as we all know insurers use analytics all the time and have a long extensive history of doing so, in as much as news in the past has denied consumers services based on some of their algorithms and created numerous law suits. Models are not bad if they are accurate and paint a good picture than being used to make money only with little or no regard for the ultimate end consumer who is subject to the criteria entered. When this occurs we end up with the

financial service, and insurance providers. This should come as no surprise as we all know insurers use analytics all the time and have a long extensive history of doing so, in as much as news in the past has denied consumers services based on some of their algorithms and created numerous law suits. Models are not bad if they are accurate and paint a good picture than being used to make money only with little or no regard for the ultimate end consumer who is subject to the criteria entered. When this occurs we end up with the

they said that

they said that

s noted in the link below from February of this year.

s noted in the link below from February of this year.  complicated this really is and nor does it address the amount of hours and work that has already been spent here. Again, complexities and providing the DOD with their real time needs as well as integrating with current VA systems is a huge chore and I can’t think of any other Health IT project that encompasses so many needs and areas of medical records, it is unique. Sad our folks in DC just see it as “just another decision” and expect budgets and time to “grow on trees” to get it done. I started out years ago stating that Congress could use some bigger technologies in modeling and creating laws but again they seem to think their brains are above it and we get the constant soap opera rhetoric on a steady diet in the news.

complicated this really is and nor does it address the amount of hours and work that has already been spent here. Again, complexities and providing the DOD with their real time needs as well as integrating with current VA systems is a huge chore and I can’t think of any other Health IT project that encompasses so many needs and areas of medical records, it is unique. Sad our folks in DC just see it as “just another decision” and expect budgets and time to “grow on trees” to get it done. I started out years ago stating that Congress could use some bigger technologies in modeling and creating laws but again they seem to think their brains are above it and we get the constant soap opera rhetoric on a steady diet in the news.  as companies adopted new accounting rules and disclosed huge goodwill write-offs (for example, AOL - $54 billion, SBC - $1.8 billion, and McDonald's - $99 million). While impairment charges have since then gone relatively unnoticed, they will get more attention as the weak economy and faltering stock market force more goodwill charge-offs and increase concerns about corporate

as companies adopted new accounting rules and disclosed huge goodwill write-offs (for example, AOL - $54 billion, SBC - $1.8 billion, and McDonald's - $99 million). While impairment charges have since then gone relatively unnoticed, they will get more attention as the weak economy and faltering stock market force more goodwill charge-offs and increase concerns about corporate  being created as Google is moving in to the top floors and the landlord is preparing and remodeling for their new tenant. As it reads, noise is not addressed in their lease and so this will end up being some type of a judgment decision. Google will be the largest tenant in the building when completed. Allscripts has been a tenant for nine years.

being created as Google is moving in to the top floors and the landlord is preparing and remodeling for their new tenant. As it reads, noise is not addressed in their lease and so this will end up being some type of a judgment decision. Google will be the largest tenant in the building when completed. Allscripts has been a tenant for nine years.  for about $8.7 billion, sidestepping the lengthier process of an initial public offering.

for about $8.7 billion, sidestepping the lengthier process of an initial public offering.

its lead author has acknowledged.

its lead author has acknowledged. glucose levels and now with this approved test there’s a somewhat one stop test to do it. A value of 6.5% will indicated the condition. The text is manufactured by Roche. BD

glucose levels and now with this approved test there’s a somewhat one stop test to do it. A value of 6.5% will indicated the condition. The text is manufactured by Roche. BD  licensing data sellers to give an alternative route of revenue to help support Healthcare and being that it is an intangible huge amount of profiteering, not many could get their heads around it, while companies and banks put billions away in profits here, and a lot of it is healthcare data that is sold that does not fall under HIPAA. It’s that old digital literacy issue again and not understanding or trying to make an effort to understand how all of this works and the IRS seemed to be too busy chasing the non profit GOP factions out there to pay much attention here. This would make an excellent area to use excise taxing to help support Healthcare reform instead of continuing to pad the pockets of banks and companies, and some of them use data out of context against consumers, instead of all the time wasted in front of Congress just crying about cuts.

licensing data sellers to give an alternative route of revenue to help support Healthcare and being that it is an intangible huge amount of profiteering, not many could get their heads around it, while companies and banks put billions away in profits here, and a lot of it is healthcare data that is sold that does not fall under HIPAA. It’s that old digital literacy issue again and not understanding or trying to make an effort to understand how all of this works and the IRS seemed to be too busy chasing the non profit GOP factions out there to pay much attention here. This would make an excellent area to use excise taxing to help support Healthcare reform instead of continuing to pad the pockets of banks and companies, and some of them use data out of context against consumers, instead of all the time wasted in front of Congress just crying about cuts.  In summary how will this tax all play out through out healthcare and what new laws will be proposed to circumvent some of this? They will fail as we have not take any effort to establish who the data sellers are and what kind of data they sell and to who. In the meantime, watch the nonsense here with more complexities added on who eventually pays the excise tax..a sad state of affairs here with trying to find a resolution with nobody bringing another plan to the table. BD

In summary how will this tax all play out through out healthcare and what new laws will be proposed to circumvent some of this? They will fail as we have not take any effort to establish who the data sellers are and what kind of data they sell and to who. In the meantime, watch the nonsense here with more complexities added on who eventually pays the excise tax..a sad state of affairs here with trying to find a resolution with nobody bringing another plan to the table. BD  and getting more accurate all the time. With using 3D modeling, matches are made to find the identity of individuals. “Faceprint” is the new word to be aware of. As pointed out the technologies need large data bases in order to work. There is no regulation on companies using the technology. The scientist who created the technology is even worried about the misuse by companies. He feels he created a “monster” now as the technology moves forward.

and getting more accurate all the time. With using 3D modeling, matches are made to find the identity of individuals. “Faceprint” is the new word to be aware of. As pointed out the technologies need large data bases in order to work. There is no regulation on companies using the technology. The scientist who created the technology is even worried about the misuse by companies. He feels he created a “monster” now as the technology moves forward.  of IT infrastructure with rules lined out, it will fail and that’s exactly what we have here with all the feeble attempts to create consumers privacy laws with any kind of data, medical and otherwise and HIPAA offers little help sometimes and still remains in a silo at HHS.

of IT infrastructure with rules lined out, it will fail and that’s exactly what we have here with all the feeble attempts to create consumers privacy laws with any kind of data, medical and otherwise and HIPAA offers little help sometimes and still remains in a silo at HHS.  with Richard Cordray at the top as he’s building a data base to study and see how all this works, too bad we have someone who needs to learn all of this and we don’t have an expert who knows and understands the mechanics so I guess we have to pay for his education now too, a sad state of affairs when we have to spend more tax dollars to educate an attorney, and that doesn’t cut it today. He has no clue and is way in over his head and this is why we need folks with some technology in their backgrounds as attorneys are good at research but they are not movers when they don’t have a tech background to combine with it. I like our President and a lot of what he is doing but for the life of me I can’t understand why he keeps putting lawyers in positions to where they have no ability or education and expect them to produce results as most of them are digital illiterate when it comes to issues like this.

with Richard Cordray at the top as he’s building a data base to study and see how all this works, too bad we have someone who needs to learn all of this and we don’t have an expert who knows and understands the mechanics so I guess we have to pay for his education now too, a sad state of affairs when we have to spend more tax dollars to educate an attorney, and that doesn’t cut it today. He has no clue and is way in over his head and this is why we need folks with some technology in their backgrounds as attorneys are good at research but they are not movers when they don’t have a tech background to combine with it. I like our President and a lot of what he is doing but for the life of me I can’t understand why he keeps putting lawyers in positions to where they have no ability or education and expect them to produce results as most of them are digital illiterate when it comes to issues like this.

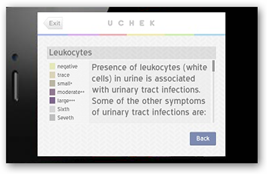

stricter rules for apps that directly diagnose or treat conditions, proposing in 2011 to apply similar quality standards as for heart stents, ultrasound machines and other medical devices.

stricter rules for apps that directly diagnose or treat conditions, proposing in 2011 to apply similar quality standards as for heart stents, ultrasound machines and other medical devices.  and some were able to get the prescription for the cancer drug, “off label” to treat Alzheimer’s. This is actually sad that it didn’t work so there are still patients wanting the treatment, and again the studies were never replicated as was originally reported. The drug, Targretin can also damage the liver so another side effect. BD

and some were able to get the prescription for the cancer drug, “off label” to treat Alzheimer’s. This is actually sad that it didn’t work so there are still patients wanting the treatment, and again the studies were never replicated as was originally reported. The drug, Targretin can also damage the liver so another side effect. BD