This is a great article and some folks who have some foresight here. I write the Medical Quack to bring some understanding to the layman level as best I can and already I’m seeing this in some of the stuff in healthcare. You can’t turn linear data into non linear and expect to find relationships that have value. CEOs will squash their Quants to the max though to come up with something they can sell. Boy have we seen that and it just doesn’t work. I keep touting the videos on the left hand side of this blog and if you want some answers and explanations, watch them. These are people smarter than me and in my time of developing software it’s the same mechanics with queries and developing analytics software, just bigger today and more headaches to find that one in a million model that “may” be correct and “may” work.

level as best I can and already I’m seeing this in some of the stuff in healthcare. You can’t turn linear data into non linear and expect to find relationships that have value. CEOs will squash their Quants to the max though to come up with something they can sell. Boy have we seen that and it just doesn’t work. I keep touting the videos on the left hand side of this blog and if you want some answers and explanations, watch them. These are people smarter than me and in my time of developing software it’s the same mechanics with queries and developing analytics software, just bigger today and more headaches to find that one in a million model that “may” be correct and “may” work.

When you see all these stats thrown at you day in and day out, it’s the old bait and switch as anyone who has any kind of a sales or marketing background knows that’s the oldest trick in the book to start firing back with statistics whether they are correct or not. Money drives this of course and if you have bunk stats and the person at the other end sucks in, then you have made a sale and put money in your pocket. I like accurate data and how it makes me smarter and how I can use my human brain based on good research with good clean data to make decisions. We are not getting that anymore out there all the time and it’s getting difficult to tell the difference as everyone has some really nice marketing campaigns that are done so well, it’s almost hard not to believe. Well let’s see that math formula looks good, it even has a square root in it and I’ve seen it all week, so it must be good, right…not always.

course and if you have bunk stats and the person at the other end sucks in, then you have made a sale and put money in your pocket. I like accurate data and how it makes me smarter and how I can use my human brain based on good research with good clean data to make decisions. We are not getting that anymore out there all the time and it’s getting difficult to tell the difference as everyone has some really nice marketing campaigns that are done so well, it’s almost hard not to believe. Well let’s see that math formula looks good, it even has a square root in it and I’ve seen it all week, so it must be good, right…not always.

The article says around 50% and I think that’s a fair estimation and one man said it was 40% being good data. This is one of the better posts I think I have done to explain how this works as you have big companies, NASA and others in a forum discussion on what in the heck are we doing with our big data. The gal from T-Mobile is my favorite as she comes right out and says what we are doing is “silly”. Hats off and kudos there. First part of fixing anything is recognizing there’s a problem:) Watch the video at the link below for more insight as to how this works and the discussion as it’s a good one.

We had in the news the big TIME article about the expenses of healthcare and there was no mention of Health IT, so how can you leave that out? It was a good article but left out the math and formulas and it’s the latest link in what I call my Attack of the Killer Algorithms series.

I probably read too much but occasionally I take on the garbage stats that appear when they get to the point to where they are claiming savings that “nobody” can predict. When I start seeing “trillions” in savings claimed, red flag:) I realize that I see things a little different than how how the average consumer does but keep in mind, perception is everything and I get right down to the reality of how this works as I’ve done some of this and someone who has never written a stick of code has no clue on the mechanics and thus so their perceptions will be all over the place as you just don’t know.

garbage stats that appear when they get to the point to where they are claiming savings that “nobody” can predict. When I start seeing “trillions” in savings claimed, red flag:) I realize that I see things a little different than how how the average consumer does but keep in mind, perception is everything and I get right down to the reality of how this works as I’ve done some of this and someone who has never written a stick of code has no clue on the mechanics and thus so their perceptions will be all over the place as you just don’t know.

There’s plenty of folks out there much more versed in areas than I am because that’s their area of work or focus, been that way for years so I don’t know everything but the mechanics of how this works with selling data is black and white as I intend to present it, no algorithm fairies just mechanics on how it is written and how it works. Politicians and others can talk all they want but until changes are made at this level, nothing changes.

If all of what you see out there, and let’s use the markets as an example, were so good, we could fire every analyst off the  Street, right? Point made here is there’s still levels of errors and in linear calculations, machines do it better and they the human with machine assistance can come to some “educated” conclusions, hopefully, if they are not Algo Duped if the answers don’t look quite right:)

Street, right? Point made here is there’s still levels of errors and in linear calculations, machines do it better and they the human with machine assistance can come to some “educated” conclusions, hopefully, if they are not Algo Duped if the answers don’t look quite right:)

We see a lot of “strange” perceptions too from those in Congress and a big part of this is a low or no level of participation with consumer technologies and that old paradigm of “its for those guys over there” just won’t go away. They say they participate but come on if they did, we would not be hearing some of the idiotic stuff we hear today..non participants stick out like a sore thumb, especially when they are really reaching out to gain some control over some issue and that’s why we have this deal on woman’s health that comes up, digital illiteracy. I should have started a series on the “those guys over there” as there’s certainly enough of it (grin). Those folks making laws certainly need help understanding technology for sure and the Sunshine Foundation is right here.

So coming back around on topic here, the analytics that you see out there do not all have value but developers, quants and others who have this big pressure on them to make money are getting very creative today and you about likely to see any and all kinds of analytics out there. The one big farce that I see is the FICO medication compliance  analytics, this is being sold to make money only. They are doing one heck of an effort to market though but they are using both credible and non credible data together and sure you crunch numbers to trend as that is helpful but not when you take it to the limit they have with individual scoring and these bogus results, kind of like the old grading on the curve if you are old enough to remember…yeah…you don’t' get your real score (grin), that’s the name of that tune.

analytics, this is being sold to make money only. They are doing one heck of an effort to market though but they are using both credible and non credible data together and sure you crunch numbers to trend as that is helpful but not when you take it to the limit they have with individual scoring and these bogus results, kind of like the old grading on the curve if you are old enough to remember…yeah…you don’t' get your real score (grin), that’s the name of that tune.

Remember that company Accretive and their analytics?

How do you like these business analytics at the link below? Which 50% area of Business Analytics should this fall in? I guess that depends if you are a consumer or a big corporation trying to make some millions selling data.

I agree with this article, some folks with some smarts who are not afraid to speak out, even if it is in Australia, it all works the same world wide. So you can read what I suggest to help this out because folks are just running wild with analytics and not all of it is good and manufacturing can use a boost and this is the way to do it with weaning folks of the algorithm for lunch trail and at least make some take a look at “junk” if that is what they are anticipating selling for profit when they know “real” value is not there or if they have had their quants fictionalize the risk. That happens.

An now for a little satire…Data addition and abuse, the next upcoming 12 step program?…I said this in August of 2010:) BD

Organizations have a 50-50 chance of yielding any benefits from their business analytics investments, according to Commonwealth Bank of Australia (CBA) manager of information systems and frontline analytics David Tanis.

During a panel discussion at the Gartner Business Intelligence & Information Management Summit 2013 in Sydney, SAP innovation evangelist Timo Elliott said all businesses will gain something from every business analytics investment they make, since there is a lesson to be learned even in a failed project. But Tanis, who was also on the panel, was not so optimistic.

The third panellist, QlikView vice president of global marketing Henry Seddon, was even more pessimistic, tipping the failure rate of investment into analytics to be about 60 percent.

Big data has commonly been defined by the three Vs: Variety, velocity, and volume. Many organizations are attempting to harness the potential of big data for a number of uses, from gaining meaningful business intelligence to targeting marketing strategies. Each face their own challenges in analysing the vast amounts of unstructured data that are available, which can come from many different sources, including social media and video content.

http://www.zdnet.com/au/half-of-analytics-investments-will-be-a-waste-commonwealth-bank-7000011758/

This makes it official and the two systems are the best in Orange county. The offices will be based in Irvine so I am guessing it’s in the office area of the new Hoag facility. This will be one large non profit group of 6 hospitals. The article states that patients should not really see any difference.

This makes it official and the two systems are the best in Orange county. The offices will be based in Irvine so I am guessing it’s in the office area of the new Hoag facility. This will be one large non profit group of 6 hospitals. The article states that patients should not really see any difference.  a partnership to streamline health care in Orange County with the creation of Covenant Health Network, hospital officials announced Thursday.

a partnership to streamline health care in Orange County with the creation of Covenant Health Network, hospital officials announced Thursday.  he Covenant network, based in Irvine, will focus on preventive health, new services, improved medical outcomes and access for low-income residents. Dr. Richard Afable, who has been chief executive at Hoag since 2005, will become chief executive of Covenant, effective Friday. He will be replaced at Hoag by Robert Braithwaite, the hospital's chief operating officer.

he Covenant network, based in Irvine, will focus on preventive health, new services, improved medical outcomes and access for low-income residents. Dr. Richard Afable, who has been chief executive at Hoag since 2005, will become chief executive of Covenant, effective Friday. He will be replaced at Hoag by Robert Braithwaite, the hospital's chief operating officer.

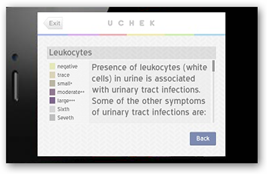

Mumbai-based Ingawale, that something is using the increasingly powerful camera and processing muscle packed in smartphones to run cheap, accurate urinalysis tests. Don’t worry, it doesn’t involved soaking your precious handset, though it does involve peeing in a cup.

Mumbai-based Ingawale, that something is using the increasingly powerful camera and processing muscle packed in smartphones to run cheap, accurate urinalysis tests. Don’t worry, it doesn’t involved soaking your precious handset, though it does involve peeing in a cup.  I have said a couple times the rating are nuts as UCLA and Boston Hospitals never seem to make the top of their listings. It’s using some type of quantitative formula for these crunched numbers and we keep getting more and more of these popping up. I have also said well just keep like a Yellow

I have said a couple times the rating are nuts as UCLA and Boston Hospitals never seem to make the top of their listings. It’s using some type of quantitative formula for these crunched numbers and we keep getting more and more of these popping up. I have also said well just keep like a Yellow Page listing and darn they can’t get that right either. So here’s the latest I found and this was national news and in the last few days this

Page listing and darn they can’t get that right either. So here’s the latest I found and this was national news and in the last few days this

If the accuracy is failing, people won’t use it. You can buy insurance off the Vitals site and it says he’s accepting new patients. A lot of this comes from the data selling epidemic that strangles the US and stifles job growth as companies and banks just sell data instead of doing much in the tangible areas for revenue growth.

If the accuracy is failing, people won’t use it. You can buy insurance off the Vitals site and it says he’s accepting new patients. A lot of this comes from the data selling epidemic that strangles the US and stifles job growth as companies and banks just sell data instead of doing much in the tangible areas for revenue growth.

found all kinds of mistakes, dead doctors, listed at hospitals they had never set foot in and so forth. Right now with insurers cutting doctors pay and many trying to keep a practice open it’s totally bogus that these sites that make money selling data and get advertising revenue want the doctors to update them. There’s other services that doctors pay for like ZocDoc, totally different as you can make appointments and it’s a service the doctor wants so they do update their profile there, so don’t confuse the two.

found all kinds of mistakes, dead doctors, listed at hospitals they had never set foot in and so forth. Right now with insurers cutting doctors pay and many trying to keep a practice open it’s totally bogus that these sites that make money selling data and get advertising revenue want the doctors to update them. There’s other services that doctors pay for like ZocDoc, totally different as you can make appointments and it’s a service the doctor wants so they do update their profile there, so don’t confuse the two.

and it hurts consumers every day and it’s growing, just like these doctor and hospital listings, same thing. Watch the videos on the left side of this blog for some real enlightenment or visit the Algo Duping Page to view and there’s a couple more on there as well. I put the 60 Minutes Report on how flawed they found all the credit agencies to be and it’s a mess.

and it hurts consumers every day and it’s growing, just like these doctor and hospital listings, same thing. Watch the videos on the left side of this blog for some real enlightenment or visit the Algo Duping Page to view and there’s a couple more on there as well. I put the 60 Minutes Report on how flawed they found all the credit agencies to be and it’s a mess.  roject, just about all the major players. You can read at the link below for a refresher. Also HealthVault was right in there too with the PHR to offer their “Direct Project’ email system. If you are a consumer with a HealthVault PHR, you can jump in there and get your physicians involved as each needs a email address. This is cool stuff.

roject, just about all the major players. You can read at the link below for a refresher. Also HealthVault was right in there too with the PHR to offer their “Direct Project’ email system. If you are a consumer with a HealthVault PHR, you can jump in there and get your physicians involved as each needs a email address. This is cool stuff.  missed that one here’s the link…and here we have our favorite Health IT satire buddies back at it. Let’s face it, what choice do you have but suicide if you can’t afford to change or are stuck for other reasons…might as well just put an end to it now:)

missed that one here’s the link…and here we have our favorite Health IT satire buddies back at it. Let’s face it, what choice do you have but suicide if you can’t afford to change or are stuck for other reasons…might as well just put an end to it now:)  , these findings have generated incredible buzz about Extormity - resulting in a disproportionate share of media attention," added Whittington. "Better yet, the focus on dissatisfaction levels has obscured questionable financial dealings, several catastrophic medical errors linked to flawed clinical decision support algorithms, and more breaches than you can shake a stick at."

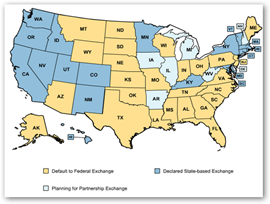

, these findings have generated incredible buzz about Extormity - resulting in a disproportionate share of media attention," added Whittington. "Better yet, the focus on dissatisfaction levels has obscured questionable financial dealings, several catastrophic medical errors linked to flawed clinical decision support algorithms, and more breaches than you can shake a stick at."  up for a large number of states too. There are two software programs, one from Oracle and one from Microsoft that appear to be packaged to make the job easier, but as we all know there’s a lot of settings and parameters even if off the shelf software is deployed, ask anyone who has installed a few servers. Now the feds would be wise to look into one or both of these I would think. Here

up for a large number of states too. There are two software programs, one from Oracle and one from Microsoft that appear to be packaged to make the job easier, but as we all know there’s a lot of settings and parameters even if off the shelf software is deployed, ask anyone who has installed a few servers. Now the feds would be wise to look into one or both of these I would think. Here  Did I mention a testing period? Will there be time for it…well someone will have to make some time and this could be a 24/7 hour endeavor by the time October rolls around. And if that doesn’t work, will the government be sending us all to Wal-Mart as an outsourced partner? They want to be an insurance exchange too:) We have Costco as a PBM now..who knows…BD

Did I mention a testing period? Will there be time for it…well someone will have to make some time and this could be a 24/7 hour endeavor by the time October rolls around. And if that doesn’t work, will the government be sending us all to Wal-Mart as an outsourced partner? They want to be an insurance exchange too:) We have Costco as a PBM now..who knows…BD

e and they are nowhere near the huge daisy chain they have. As a matter of fact the company is finally paying up on the 15 year short pay of hospitals and doctors where they licensed the algorithms that United Healthcare (Ingenix) designed and used. So we have Best Buy hawking software for Aetna, Costco selling their insurance and all kinds of other stuff going on. BD

e and they are nowhere near the huge daisy chain they have. As a matter of fact the company is finally paying up on the 15 year short pay of hospitals and doctors where they licensed the algorithms that United Healthcare (Ingenix) designed and used. So we have Best Buy hawking software for Aetna, Costco selling their insurance and all kinds of other stuff going on. BD  on the early days that he had to finally realize he could not go home at night and be able to be a lone developer and write an update for Windows 95:) Complexities have grown tremendously since then. You keep hearing me hammer on this blog about how I try to bring some of this understanding down to layman's terms, and the fact is you will probably never have the same perceptions as I do or anyone who has written any bit of extensive code, because you can’t when you don’t know the mechanics. That is what I try to bring forward and it’s not an opinion at all, it’s fact, its what it is, code is written and algorithms run. I know I scare a few folks here and there but reality is what this is all about and I’m trying to help differentiate what is real and what is written just for profit with flawed data only to make money.

on the early days that he had to finally realize he could not go home at night and be able to be a lone developer and write an update for Windows 95:) Complexities have grown tremendously since then. You keep hearing me hammer on this blog about how I try to bring some of this understanding down to layman's terms, and the fact is you will probably never have the same perceptions as I do or anyone who has written any bit of extensive code, because you can’t when you don’t know the mechanics. That is what I try to bring forward and it’s not an opinion at all, it’s fact, its what it is, code is written and algorithms run. I know I scare a few folks here and there but reality is what this is all about and I’m trying to help differentiate what is real and what is written just for profit with flawed data only to make money.  leaf did they emerge from, stay quiet if you don’t know:) The more people that are a little educated it will definitely

leaf did they emerge from, stay quiet if you don’t know:) The more people that are a little educated it will definitely  just to make a buck or if they really have something useful for mankind. There’s both out there and the selling of data is an epidemic and actually standing to ruin a lot of good programming too when exploited. Write something that you can use yourself and you will hear almost everyone one in here using their own stuff, unlike what some do, write code to just to make a buck, you have to have part of you in it. You can pretty much tell on the web with the content as to who has themselves in it and who’s just writing code and queries to make a buck.

just to make a buck or if they really have something useful for mankind. There’s both out there and the selling of data is an epidemic and actually standing to ruin a lot of good programming too when exploited. Write something that you can use yourself and you will hear almost everyone one in here using their own stuff, unlike what some do, write code to just to make a buck, you have to have part of you in it. You can pretty much tell on the web with the content as to who has themselves in it and who’s just writing code and queries to make a buck.  10 million students over the next few weeks.

10 million students over the next few weeks. institutions. Holy Moly if this gets implemented on time. I do wonder if deadlines might be extended here too. It was done once and we do have those insurance exchanges on the plate too. All of this is one heck a lot of coding and integration work in Health IT at one time. How many CIOS might consider retiring this year or maybe just walking? The top IT folks at the VA have already announced they are out of there in DC. Folks not in this side of the business still don’t get it, “the short order code kitchen burned down years ago and there was no fire sale”. I heard rumblings from various vendors about that, more at the link below. Helps when you have technologists at the top who understand this and then you don’t get statements as such. BD

institutions. Holy Moly if this gets implemented on time. I do wonder if deadlines might be extended here too. It was done once and we do have those insurance exchanges on the plate too. All of this is one heck a lot of coding and integration work in Health IT at one time. How many CIOS might consider retiring this year or maybe just walking? The top IT folks at the VA have already announced they are out of there in DC. Folks not in this side of the business still don’t get it, “the short order code kitchen burned down years ago and there was no fire sale”. I heard rumblings from various vendors about that, more at the link below. Helps when you have technologists at the top who understand this and then you don’t get statements as such. BD  garbage stats that appear when they get to the point to where they are claiming savings that “nobody” can predict. When I start seeing “trillions” in savings claimed, red flag:) I realize that I see things a little different than how how the average consumer does but keep in mind, perception is everything and I get right down to the reality of how this works as I’ve done some of this and someone who has never written a stick of code has no clue on the mechanics and thus so their perceptions will be all over the place as you just don’t know.

garbage stats that appear when they get to the point to where they are claiming savings that “nobody” can predict. When I start seeing “trillions” in savings claimed, red flag:) I realize that I see things a little different than how how the average consumer does but keep in mind, perception is everything and I get right down to the reality of how this works as I’ve done some of this and someone who has never written a stick of code has no clue on the mechanics and thus so their perceptions will be all over the place as you just don’t know.  Street, right? Point made here is there’s still levels of errors and in linear calculations, machines do it better and they the human with machine assistance can come to some “educated” conclusions, hopefully, if they are not Algo Duped if the answers don’t look quite right:)

Street, right? Point made here is there’s still levels of errors and in linear calculations, machines do it better and they the human with machine assistance can come to some “educated” conclusions, hopefully, if they are not Algo Duped if the answers don’t look quite right:)  analytics, this is being sold to make money only. They are doing one heck of an effort to market though but they are using both credible and non credible data together and sure you crunch numbers to trend as that is helpful but not when you take it to the limit they have with individual scoring and these bogus results, kind of like the old grading on the curve if you are old enough to remember…yeah…you don’t' get your real score (grin), that’s the name of that tune.

analytics, this is being sold to make money only. They are doing one heck of an effort to market though but they are using both credible and non credible data together and sure you crunch numbers to trend as that is helpful but not when you take it to the limit they have with individual scoring and these bogus results, kind of like the old grading on the curve if you are old enough to remember…yeah…you don’t' get your real score (grin), that’s the name of that tune.  I don’t know if this is the specific information relating to those data bases or not as discussed in this article as is appears that the information relates to those patients. Back in 2010 Walgreens and Omnicare swapped businesses to where Walgreens took over the home infusion business, so of course this meant some data IT work had to be done to integrate with those records owned by Omni. Omnicare has had issues in the past with

I don’t know if this is the specific information relating to those data bases or not as discussed in this article as is appears that the information relates to those patients. Back in 2010 Walgreens and Omnicare swapped businesses to where Walgreens took over the home infusion business, so of course this meant some data IT work had to be done to integrate with those records owned by Omni. Omnicare has had issues in the past with

data ahead of making money selling data. The data selling has just gone hog wild out there and when a company has to make a decision today to expand and build a factory versus hiring a few technologists to set up data mining and selling with little or no federal regulation and the millions come in from selling it off the servers, where’s the incentive for companies to create jobs when this very profitable option is available? It’s definitely something to give some thought too as when it is used out of context, and we seeing some of this along with the good, it hurts consumers. Again we don’t know what the status was on the data stolen or where it was being directed but this is a good question we might all be asking more today from all of those banks and companies selling our data. So what would one think the thieves are going to do with the data, sell it of course, so wake up time. BD

data ahead of making money selling data. The data selling has just gone hog wild out there and when a company has to make a decision today to expand and build a factory versus hiring a few technologists to set up data mining and selling with little or no federal regulation and the millions come in from selling it off the servers, where’s the incentive for companies to create jobs when this very profitable option is available? It’s definitely something to give some thought too as when it is used out of context, and we seeing some of this along with the good, it hurts consumers. Again we don’t know what the status was on the data stolen or where it was being directed but this is a good question we might all be asking more today from all of those banks and companies selling our data. So what would one think the thieves are going to do with the data, sell it of course, so wake up time. BD  TDM-1 was the name given to the drug during the clinical trial. One thing that’s not any different is the price of another life extending drug, about $9800 a month and will be available in a couple of weeks. Kadcyla is a combination of a current cancer drug, Herceptin and a chemotherapy drug named DM-1. It is to be prescribed when Herceptin is no longer effective on it’s own. DM-1 on it’s own is way too toxic to delivery into the bloodstream alone. A normal course of treatment is about 9 months so you can do the math here to see at the price listed above, it is expensive. Of course they do have a hardship program where some might be able to get the drug for free. BD

TDM-1 was the name given to the drug during the clinical trial. One thing that’s not any different is the price of another life extending drug, about $9800 a month and will be available in a couple of weeks. Kadcyla is a combination of a current cancer drug, Herceptin and a chemotherapy drug named DM-1. It is to be prescribed when Herceptin is no longer effective on it’s own. DM-1 on it’s own is way too toxic to delivery into the bloodstream alone. A normal course of treatment is about 9 months so you can do the math here to see at the price listed above, it is expensive. Of course they do have a hardship program where some might be able to get the drug for free. BD  We all know the Oscars are up and coming and that the movie has been nominated for an award. This is sad that the doctor now sits imprisoned sentenced to 33 years after helping the US. I don’t know all the details on why he was not given an opportunity to leave the country but sitting in prison for helping the US find Bin Laden doesn’t seem to where he should be by any means. The RHL group is working to bring some recognition and help to see if there’s anything that can be done.

We all know the Oscars are up and coming and that the movie has been nominated for an award. This is sad that the doctor now sits imprisoned sentenced to 33 years after helping the US. I don’t know all the details on why he was not given an opportunity to leave the country but sitting in prison for helping the US find Bin Laden doesn’t seem to where he should be by any means. The RHL group is working to bring some recognition and help to see if there’s anything that can be done.  the news? Will they read up? Who knows. This week we have yet another issue with digital illiteracy making news…the next governor vying for “Governor Ultrasound” recognition. It’s digital illiteracy breaking out at the seems as we wouldn’t see stuff like this if they were not lost in the world of technology. It gives MSNBC a ton of material to work with as well. Don’t these guys ever think about how the “educated” world sees them?

the news? Will they read up? Who knows. This week we have yet another issue with digital illiteracy making news…the next governor vying for “Governor Ultrasound” recognition. It’s digital illiteracy breaking out at the seems as we wouldn’t see stuff like this if they were not lost in the world of technology. It gives MSNBC a ton of material to work with as well. Don’t these guys ever think about how the “educated” world sees them?  Jon Stewart does a pretty good job with this serious topic. There are 3 parts to the interview. The point out that non-profits do make money. MRIs are one of the first topics discussed and that has been in the news of late with the various charges and prices you get. All the pricing is done with IT infrastructures that build on itself. They don’t even touch the Health IT expenditures and how some of that goes. I do that enough here. Today saw this article about start ups and almost everyone of them looks like it has a model to sell data.

Jon Stewart does a pretty good job with this serious topic. There are 3 parts to the interview. The point out that non-profits do make money. MRIs are one of the first topics discussed and that has been in the news of late with the various charges and prices you get. All the pricing is done with IT infrastructures that build on itself. They don’t even touch the Health IT expenditures and how some of that goes. I do that enough here. Today saw this article about start ups and almost everyone of them looks like it has a model to sell data.  a lot of what I talk about government snowed by corporate USA business models and the complexities they build, to make money. If you want to see more about how it works, watch the videos in the left hand side of this blog or visit the “

a lot of what I talk about government snowed by corporate USA business models and the complexities they build, to make money. If you want to see more about how it works, watch the videos in the left hand side of this blog or visit the “