If you have read here often enough then you have probably stumbled on to one of my post about privacy and the data sellers. Certainly the FTC is addressing the data brokers here and again they are relying on trust. Right now the credit agencies run some queries and “allow” you to see what they “allow” you to see so when someone else such as a bank or any other type of entity doing a credit check, they get a lot more than what you see. Ok so we ask the data brokers to do the same, trust them…can’t trust credit agencies due to all the flawed data out there. Flawed data is rising due to all the data selling taking place, a bit root cause.

addressing the data brokers here and again they are relying on trust. Right now the credit agencies run some queries and “allow” you to see what they “allow” you to see so when someone else such as a bank or any other type of entity doing a credit check, they get a lot more than what you see. Ok so we ask the data brokers to do the same, trust them…can’t trust credit agencies due to all the flawed data out there. Flawed data is rising due to all the data selling taking place, a bit root cause.

As you can see there’s no root to regulate any of this other than just a couple data brokers saying “we will now let you see what we have”…probably due to folks threatening lawsuits somewhere along the line, as it’s flawed so much of the time. When you take non credible data and combine it with credible data, the chance for flaws grows tremendously. I read the FTC keynote speech here and there’s a lot left to be desired. The proposed laws have no teeth and no room for any kind of regulation so we have a bunch of words called a law that technologists will quickly model to use data methodologies to skid on the legal words and still get and sell their data:)

The FTC didn’t mention the huge profits made and Barclays Bank just stated they were going to start selling their client data. Sure it’s de-identified, but don’t hold your breath there as Quants and data scientists can rematch data pretty quickly these days and I used to do it when writing software to verify query results for my own use to ensure my software was working correctly, methodologies been around for a long time. It depends on the “Query Master” if you ask me. I just love to see companies like Walgreens on the SEC statement making around a billion dollars a year selling data, not.

Privacy Wanted–So Let’s Require Those Who Sell Web Data to Register and Tax the Transactions and Publicly Disclose Who They Sell To With a Federal Registry

Then we have these folks, the e-scoring folks who will never let you see what they sell about you, and now we are talking credit data and not de-identified information.

E-Scoring Credit Algorithms Invisible To Consumers Used to Market and Evaluate, Does Not Fall Under Federal Law And Such Are Used by Insurance Companies - How Will This Work With Exchanges –Attack of the Killer Algorithms Chapter 42

Again the data is getting more flawed by the sale as the agency buying the information has a few data bases they query it with and gee in a few days we have new analytics or predictive analytics out there for all to spend and buy.

So what happens when big data says your name is not machine complaint? Happened to me as Google thought I was a real duck, machine has not learned enough yet:) Yes I laughed at this one since it was only social networking and the guys over MIT got big kick out of it too but really you have a big conglomerate telling me that the name I have used for 58 years is not “machine compliant”..think about it and take a look at the Attack of the Killer Algorithm series to where these are every day events where the data gets it wrong or the model lied to make profits. I also had my car insurer’s machine learning add a second driver to my policy, the folks who bought the house I sold, and it was months later, so see how mining gets it wrong too. I’m just one person, have 2 incidents already so imagine how wide spread this is? I also know how data bases and queries work as well and the levels of error factors.

“I’m Sorry Your Google Plus Name Does Not Comply With Google “Names Policies”…Barbara “Duck Algorithm” & Was Using My Real Name All Along…Killer Algorithms Chapter 52

Now let’s get into the facial recognition…the newest tool out there for data sellers…link to 60 Minute report below on this, even the creator is worried about it’s misuse. The answer is for step one folks to require ALL data sellers to buy a license, just like a stock broker does or a doctor or a real estate sales agent. States have been having issues too with licensing data broker bots as their servers slow down to a crawl and you and I can’t get in so they put governor software software on the servers to limit the bots, that’s how busy and infiltrated this all is.

Licensing and Excise Taxing Data Sellers, Facial Recognition Yet One More Tool Used To Secure & Match Data - The Epidemic, Billions in Profits for Banks and US Corporations Using Killer Algorithms to Further Erode Consumer Privacy

How about all these insurance companies buying your Master Card and Vista charge and debit records…the justification from Blue Cross will pretty funny actually when they said they were seeing if their insured were buying a size larger clothes..so there you go, the query masters at work and once they have the data what else do they query it with…only the query master knows for sure..and then they sell it in one form or another.

Insurance Companies Are Buying Up Consumer Spending Data-Time is Here to License and Tax the Data Sellers-As Insurers Sell Tons of Data, Gets Flawed Data When Data Buyers Uses Out of Context Too

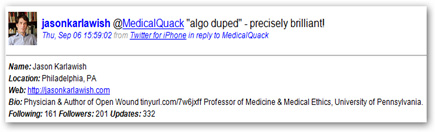

This is a good tweet and I agree and have used it a lot stating proprietary algorithms have become the unspoken law and they have with digital illiterate or digitally bliss government departments sadly.

Ok so moving forward we have this “big” announcement that one of the data brokers is going to allow you to see what they have about you…they are not doing this to be nice…let’s move forward and a couple more do the same…well guess what…now let’s get a dashboard of many brokers and who’s going to profit and make money doing that platform…software builds on itself. It will end up just as complex as insurance exchanges with some data broker getting a federal contract in the name of transparency to do it.

See is this how data folks think where the average consumer can’t see down the road with the mechanics and money making portions of all of this. Oh gosh and gee to provide this for consumers the FTC will be asking Congress for grants to support this and help educate consumers on how to use it…not hard to visualize the direction this could go:) If Congress says no, as they probably would not understanding all of the mechanics, then do we have the FTC asking for private industry to help toss in some money, like HHS did with the exchanges for insurance?

Platforms can be very good and useful but they can also be money makers to create more markets for more software that ends up being useless and the results taken out of context. Video at the link below shows NASA and others in a forum discussion about “what are we doing with big data” and is one of the few that brings in the Quants and data scientists and their work. Pull a rabbit out of the hat as they try non linear methodologies at times.

Big Data/Analytics If Used Out of Context and Without True Values Stand To Be A Huge Discriminatory Practice Against Consumers–More Honest Data Scientists Needed to Formulate Accuracy/Value To Keep Algo Duping For Profit Out of the Game

Then we have our consumer protection chief desperately trying to figure out how consumers interact with financial transactions and his answer is to build a data base…pretty funny and yet sad as we don’t have time for Richard Cordray to learn all of this, put a technologist in his place and back that person with legal help. We have it totally backwards now and he’s treading water without some IT infrastructure knowledge. happens all the time any more and then we have these huge unintended consequences as private industry models around the government bliss and sticks them behind the 8 ball every time and that’s where I see him sitting today sadly.

time for Richard Cordray to learn all of this, put a technologist in his place and back that person with legal help. We have it totally backwards now and he’s treading water without some IT infrastructure knowledge. happens all the time any more and then we have these huge unintended consequences as private industry models around the government bliss and sticks them behind the 8 ball every time and that’s where I see him sitting today sadly.

Richard Cordray, Fail With Understanding Flawed Models and Algorithms -Big Case of“Algo Duping”With Big Data-Save Time, Hire Quants Who Know How Consumer Financial Models Are Built and Function…Geez

After all the big conglomerates have made billions selling your data and you find errors, well guess who’s ticket it’s on to fix it, your dime and there’s no accountability. 60 Minutes got that right too as consumers have had to hire attorneys, etc. to fight a lot of this, again once your data is sold, it’s strict overhead to offer customer service to fix it and again the video will show you what you get, not much as they made their money and there’s no interest in spending non profitable time and efforts to fix it. They are on to the next sale.

Again if the US government is every going to get serious about privacy they should update themselves with the times and start a system where we can identify and track who all the data sellers are, what they are selling and reselling and to who. As I have mentioned on many occasions an excise tax on the billions in profits made could easily go to help fund the consumer agencies of the NIH and FDA, two of the most important government agencies we need.

Time Has Come to License and Tax the Data Sellers of the Web, Companies, Banks, Social Networks..Any One Making a Profit-Latest Microsoft/Google Privacy War Helping the Cause –Consumers Deserve to Know What Is Being Sold and To Who in a Searchable Format

In summary with both privacy and accountability, this falls far short of what is really needed with any teeth for sure and again it is so sad that it appears that technologists are not fully consulted with some of this as you get people like me poking holes in it all over the place. Certainly there’s nothing going to be perfect but license and taxing gives an avenue to regulation, what is needed as I’m tired of seeing the government that is supposed to help protect consumers spending much of their time behind the 8 ball. Hire some quants and see what goes on with the other side instead of just trusting what you hear.

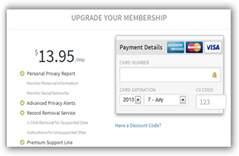

The Algo Duping page videos will help educate and you understand where I am coming from in mostly layman’s terms and the videos are worth watching as they are done by people smarter than me but also offer the truth and logic without the OMG emotional distractions, it is what it is. Sounds like some of the folks have been sucked in with some Algo Duping and unless you look at some other angles anyone can be sucked in believing fictions numbers and models. I have been trying the “free” version of a privacy monitoring service called Safe Shepherd and they do run algorithms and see what is reported on you but we have a bait and switch here too as they want me to “pay” around $14 a month to have the service remove what they find, so they get you coming and going as a consumer, more money here and more money there…

Numbers don’t lie but people do. Licensing and excise taxing along with a federal look up site with a simplified format on what kind of data is sold and who they sell it to would go a long ways, much more efficient and create a revenue stream than going the platform route to complicate it even more for consumers who are already getting ripped with flawed data and it’s getting worse. Violations, then we have potential fines or loss of a license at stake, much better for regulation than what I read in this claim your data idea. The tax for the profiteers could use a sale tax model, every quarter and who knows we might capture some of that tax money that goes outside the country under a model like this too. BD

Big Data, Flawed Data, Business Intelligence, Where’s The Future and What Has Been Our Past…A World With ”Algo Duping” of Society and Consumers

One industry under the microscope is data brokerages. These are business-to-business companies that collect thousands of details — like the shopping habits, vacation preferences, estimated income, ethnicity, hobbies, predilections for gambling or smoking and health concerns — about millions of consumers, the better to help marketers identify potential new customers as well as maintain their already loyal clients.

Although some of these companies do permit people to opt out of their marketing databases, most do not have systems to allow consumers to see records held about them and correct possible errors. Because of this lack of transparency, federal regulators and privacy advocates have long warned about the potential for such data-mining to discriminate against consumers based on sensitive details like financial or health information

was no non hormonal drug out there for hot flashes? It supposedly met the goals in clinical trials but those who voted against it said it was only minimally effective. Does it do better than natural black cohosh is the question that comes to mind. So I guess if one is on Paxil that has the same active ingredient, you could be getting a double bang for the buck? We do know that hormones work but they also have their inherent cancer dangers as well. If you want to learn more about hot flashes scroll down and check out

was no non hormonal drug out there for hot flashes? It supposedly met the goals in clinical trials but those who voted against it said it was only minimally effective. Does it do better than natural black cohosh is the question that comes to mind. So I guess if one is on Paxil that has the same active ingredient, you could be getting a double bang for the buck? We do know that hormones work but they also have their inherent cancer dangers as well. If you want to learn more about hot flashes scroll down and check out  When ACOs first came out, really nobody quite knew what they were and the structure but all knew they should join one as all were about saving money with good care. Now we have some folks either wanting to jump ship or move into another program with fewer penalties and no incentives, kind of takes the pressure off. You really can’t blame them as the business models of insurers almost change by the hour and contract and compensation are hard to nail down. Also too the Supreme Court made a big announcement whereby doctors can now work as groups with litigating billing or contractual agreements. It doesn’t have to be the big corporation against one doctor any more as what had been in most contracts. Also, ask any patient what an ACO is…see what answer you get.

When ACOs first came out, really nobody quite knew what they were and the structure but all knew they should join one as all were about saving money with good care. Now we have some folks either wanting to jump ship or move into another program with fewer penalties and no incentives, kind of takes the pressure off. You really can’t blame them as the business models of insurers almost change by the hour and contract and compensation are hard to nail down. Also too the Supreme Court made a big announcement whereby doctors can now work as groups with litigating billing or contractual agreements. It doesn’t have to be the big corporation against one doctor any more as what had been in most contracts. Also, ask any patient what an ACO is…see what answer you get. Some of such software is sold by subsidiaries of health insurance companies anyway so if that’s the case on some of the expense, then no use in double dipping insurers for additional profits I think is the way most doctors would look at it. You may have a tough time though figuring it out as the

Some of such software is sold by subsidiaries of health insurance companies anyway so if that’s the case on some of the expense, then no use in double dipping insurers for additional profits I think is the way most doctors would look at it. You may have a tough time though figuring it out as the  The article states it will consider an IPO for GE Capital and I am assuming there could be other divisions rolled in here besides just this one when it all comes out. This company as a stand alone with relying on consumer financing might be one investors may want to dig in deeper to take a look at. This brings me to a recent post about SEC Tiered subsidiaries as we are not seeing the big picture any longer with many companies and I don’t know if this is the case with GE but so many are not listing subsidiaries anymore with the SEC, so hard to see the whole picture and I am really beginning to wonder with complexities today what impact this is going to have not only with clients but investors as well. How much is all this consumer debt worth I guess is the big question, 2 billion? BD

The article states it will consider an IPO for GE Capital and I am assuming there could be other divisions rolled in here besides just this one when it all comes out. This company as a stand alone with relying on consumer financing might be one investors may want to dig in deeper to take a look at. This brings me to a recent post about SEC Tiered subsidiaries as we are not seeing the big picture any longer with many companies and I don’t know if this is the case with GE but so many are not listing subsidiaries anymore with the SEC, so hard to see the whole picture and I am really beginning to wonder with complexities today what impact this is going to have not only with clients but investors as well. How much is all this consumer debt worth I guess is the big question, 2 billion? BD provide better mental health care. Some of the issues addressed were not seeing patients in a timely manner and not telling patients that long term psychiatric care is not available. In the article one doctor is quotes as saying that he feels Kaiser has not taken mental illness care as seriously as they have physical illness. BD

provide better mental health care. Some of the issues addressed were not seeing patients in a timely manner and not telling patients that long term psychiatric care is not available. In the article one doctor is quotes as saying that he feels Kaiser has not taken mental illness care as seriously as they have physical illness. BD  a good chance they may not be located there, but rather in China, India, Turkey or other countries. This is a good time to take a look at the 60 minute report and how much money the counterfeit drug companies make. See how Pfizer has people employed to help catch them.

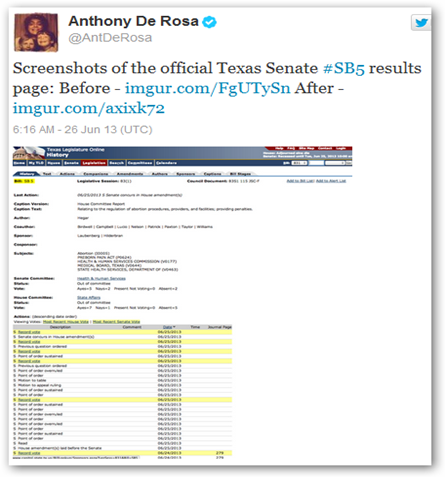

a good chance they may not be located there, but rather in China, India, Turkey or other countries. This is a good time to take a look at the 60 minute report and how much money the counterfeit drug companies make. See how Pfizer has people employed to help catch them.  that “abortions” are the default fall back topic of those who are not adequately digital literate and this kind of proves it when you have a live broadcast with folks that are digital literate watching for some kind of altering of real time events. I would call this a case of “Redneck Killer Algorithms” as they tried to alter a process that was handled by a process smarter than they are.

that “abortions” are the default fall back topic of those who are not adequately digital literate and this kind of proves it when you have a live broadcast with folks that are digital literate watching for some kind of altering of real time events. I would call this a case of “Redneck Killer Algorithms” as they tried to alter a process that was handled by a process smarter than they are.

, I have never seen so many lawmakers that detest and avoid education with technology and I guess more proof as such not to mention embarrassment of exposure like this is needed? Have we not seen enough? This is a big duh! You might say the Texas legislature was

, I have never seen so many lawmakers that detest and avoid education with technology and I guess more proof as such not to mention embarrassment of exposure like this is needed? Have we not seen enough? This is a big duh! You might say the Texas legislature was  , and hopefully eliminate further showings such as this one that occurred in Texas, aka “Redneck Killer Algorithms”. I’m not the only one out there watching by any means, and a public exposure of such is pretty scary and who knows what legal ramifications may come out of this but again this is the OMG abortion group at their best and if this is the best, I shudder to see what the worst is.

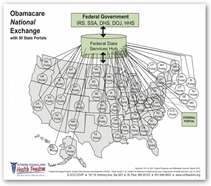

, and hopefully eliminate further showings such as this one that occurred in Texas, aka “Redneck Killer Algorithms”. I’m not the only one out there watching by any means, and a public exposure of such is pretty scary and who knows what legal ramifications may come out of this but again this is the OMG abortion group at their best and if this is the best, I shudder to see what the worst is.  EC after the presidential election and others to where United said they were not required to report the purchase to the SEC and it looks like they were right under the current explanation of “significant operations”. As I look at this having the contract to develop the Federal Data Hub that all state exchanges will connect with, as well as the IRS, Social Security, Immigration and more is a “significant operation” especially when the Inspector General is all over them for having the same issues that Booz Allen had in the news with USB drive security. A contract is awarded and 2 weeks later the company, QSSI is sold to United.

EC after the presidential election and others to where United said they were not required to report the purchase to the SEC and it looks like they were right under the current explanation of “significant operations”. As I look at this having the contract to develop the Federal Data Hub that all state exchanges will connect with, as well as the IRS, Social Security, Immigration and more is a “significant operation” especially when the Inspector General is all over them for having the same issues that Booz Allen had in the news with USB drive security. A contract is awarded and 2 weeks later the company, QSSI is sold to United.  by owning subsidiaries, I try to keep that up front so you know which big conglomerate profits at the bottom line when you do business with one of their subsidiaries.

by owning subsidiaries, I try to keep that up front so you know which big conglomerate profits at the bottom line when you do business with one of their subsidiaries.  Rules need to change for more reasons than one as I for one would like to be able to look at an SEC filing and see all the subsidiaries and their

Rules need to change for more reasons than one as I for one would like to be able to look at an SEC filing and see all the subsidiaries and their  around 4000 applications for products that claim to be equivalent to other products already on the market. Some companies have been waiting for over 2 years for an approval.

around 4000 applications for products that claim to be equivalent to other products already on the market. Some companies have been waiting for over 2 years for an approval.  to search and find the providers who are within the range of the caps. If employees do not learn how to use the software then phone service will be provided. More and more in order to save money it is dependent on the use of software. The new insurance exchanges are the same with millions in grants being put out to fund “navigators’, which again is basically learning how to use the software and how filters work to make a selection for health insurance.

to search and find the providers who are within the range of the caps. If employees do not learn how to use the software then phone service will be provided. More and more in order to save money it is dependent on the use of software. The new insurance exchanges are the same with millions in grants being put out to fund “navigators’, which again is basically learning how to use the software and how filters work to make a selection for health insurance.  are there just to promote some kind of advertising anymore and the files are dated. If you read here often enough you know that story. Yes indeed it would be a lot nicer to have one set of numbers to work with instead of having to shop doctors, labs and imaging centers. It’s a royal pain and of course you are always on your own dime doing so. So here we go, more money for the middle companies and consumers need to learn more software techniques to filter and shop from the employer provided insurance side.

are there just to promote some kind of advertising anymore and the files are dated. If you read here often enough you know that story. Yes indeed it would be a lot nicer to have one set of numbers to work with instead of having to shop doctors, labs and imaging centers. It’s a royal pain and of course you are always on your own dime doing so. So here we go, more money for the middle companies and consumers need to learn more software techniques to filter and shop from the employer provided insurance side.  The employees at the China factory claim they have not been paid, blocked the doors and have locked him in until they can negotiate. This happened last Friday and he’s been barricaded since then. The Chinese government is pretty much hands off and it’s not unusual in the country for employees to take this into their own hands. Gee could this catch on over here (grin)?

The employees at the China factory claim they have not been paid, blocked the doors and have locked him in until they can negotiate. This happened last Friday and he’s been barricaded since then. The Chinese government is pretty much hands off and it’s not unusual in the country for employees to take this into their own hands. Gee could this catch on over here (grin)?  in 2010. If you visit the website the

in 2010. If you visit the website the  Enterprise Community Investment and the two worked together on this to build and provide medium to to income housing, rentals. We see Blackstone in a much bigger way buying up vacant homes in Arizona and Nevada. Housing market is not back for the middle class, it’s the investors with cash. So when you end up filing bankruptcy as your health insurance doesn't cover what you need, well United Health Group wants to be there to help collect some rent after you lose your home. I don’t know if this is an

Enterprise Community Investment and the two worked together on this to build and provide medium to to income housing, rentals. We see Blackstone in a much bigger way buying up vacant homes in Arizona and Nevada. Housing market is not back for the middle class, it’s the investors with cash. So when you end up filing bankruptcy as your health insurance doesn't cover what you need, well United Health Group wants to be there to help collect some rent after you lose your home. I don’t know if this is an

so their focus for income appears to be focused heavily on both employer and especially government contracts as are a few others, but none are as large as United. As of a couple weeks ago,

so their focus for income appears to be focused heavily on both employer and especially government contracts as are a few others, but none are as large as United. As of a couple weeks ago,  This is a quote from the video and there’s a big focus on Wisconsin here and their influence in the state and with Scott Walker. The Koch brothers were the largest investors behind his campaign.

This is a quote from the video and there’s a big focus on Wisconsin here and their influence in the state and with Scott Walker. The Koch brothers were the largest investors behind his campaign.  she did not know her audience in San Jose of very high intellectual people who build technologies, some like what gets sold to the government and of course they were offended as the technologists don’t get the credit a lot of times for their intelligence and what they know and how they created models and algorithms that control money. ALEC as you can see by watching the Bill Moyer video is right in there, teaching modeling for profit and the feds end up once again on the short end of the stick and it comes down to money and digital illiteracy.

she did not know her audience in San Jose of very high intellectual people who build technologies, some like what gets sold to the government and of course they were offended as the technologists don’t get the credit a lot of times for their intelligence and what they know and how they created models and algorithms that control money. ALEC as you can see by watching the Bill Moyer video is right in there, teaching modeling for profit and the feds end up once again on the short end of the stick and it comes down to money and digital illiteracy.

and that didn’t work and they were pretty aggressive and ended up giving up their efforts. It was hot news for a while and ended up with Tenet filing a lawsuit against Community stating they were inflating hospital admissions in 2011.

and that didn’t work and they were pretty aggressive and ended up giving up their efforts. It was hot news for a while and ended up with Tenet filing a lawsuit against Community stating they were inflating hospital admissions in 2011.  purchase amount. Tenet themselves lost money in the first quarter of this year due to a lower number of admissions. A few years ago Vanguard sold some of their hospitals to Prime Healthcare here in Orange County. La Palma and Huntington Beach hospitals were two of the medical centers sold.

purchase amount. Tenet themselves lost money in the first quarter of this year due to a lower number of admissions. A few years ago Vanguard sold some of their hospitals to Prime Healthcare here in Orange County. La Palma and Huntington Beach hospitals were two of the medical centers sold. as we all know how an algorithm can run through, based on the parameters programmed and make major changes..just look at the stock market for yet another example. Only your “Query Master” knows for sure and writes the code used.. Back in 2011, Med Solutions and Blue Cross were caught with the Stress Test Denial Algorithm. See what I mean when I say

as we all know how an algorithm can run through, based on the parameters programmed and make major changes..just look at the stock market for yet another example. Only your “Query Master” knows for sure and writes the code used.. Back in 2011, Med Solutions and Blue Cross were caught with the Stress Test Denial Algorithm. See what I mean when I say

They have opening admitted they don’t know if any money will be saved but in working with Blue Cross on some of this they are making some headway with what they will pay for certain surgical procedures. Hospitals don’t want to lose patients so if they are too far out of the ball park, and consumers have to pick up the rest of the bill they look else where.

They have opening admitted they don’t know if any money will be saved but in working with Blue Cross on some of this they are making some headway with what they will pay for certain surgical procedures. Hospitals don’t want to lose patients so if they are too far out of the ball park, and consumers have to pick up the rest of the bill they look else where.